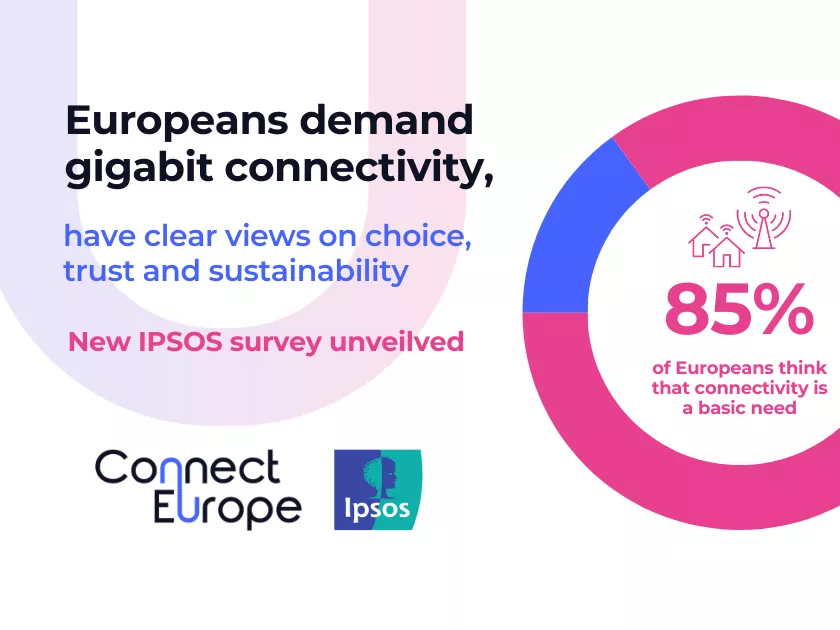

New IPSOS consumer survey unveiled: Europeans demand gigabit connectivity, have clear views on choice, trust and sustainability

This survey is particularly relevant as the European Parliament and the new European Commission start discussing telecoms policies for the coming years.

Brussels, 24 October 2024 – Connect Europe, the association representing the leading connectivity providers in Europe, and IPSOS, the global market research leader, have released today “Europe's Digital Pulse: connectivity trends and consumer insights", a new consumer survey examining the digital habits and expectations of consumers across 30 European countries. The main finding of the survey is that an overwhelming majority of Europeans considers connectivity as a basic need and that most businesses see new gigabit networks as a growth opportunity.

Connectivity services: Europeans think they are essential, businesses want 5G and FTTH

IPSOS found that 85% of Europeans think that connectivity is for them a basic need. In addition, the report finds that over 60% of small business owners believe that “new network technologies like 5G and fibre optics present an opportunity to improve and grow their business”. This further strengthens the case for taking urgent action to connect all users to advanced gigabit networks, as outlined in the Mission Letter of EVP Henna Virkkunen, calling to pass a Digital Networks Act, and reconfirms the findings in recent high-level reports by Mario Draghi and Enrico Letta.

Competition, choice, satisfaction: consumers are happy, have choice and are driven by price as well as quality

In terms of choice and competition within telecom markets, the survey shows positive sentiments. IPSOS found that European consumers are generally satisfied with their telecom providers, with 64% of Europeans who have both fixed internet and mobile plans with the same provider rating them 8 or higher out of 10. In addition, a substantial 74% of European consumers feel that there are enough providers to choose from, and 67% believe there is sufficient variety in the offers available. Also, almost 60% of those surveyed think that switching providers is simple and quick. When it comes to the top drivers in choosing the telecom operator for their fixed internet, price and quality come out on top: 59% of consumers are driven by price, 49% are driven by reliability of the connection and 45% by speeds.

Trust and security: consumers trust telcos more than tech, gaps remain on risky behaviour

Data security is another critical area explored in the survey. A significant 81% of Europeans are concerned about the security of their personal data. Despite this concern, many still engage in risky behaviour, with only 45% using strong and unique passwords. Notably, 59% of respondents believe that telecom providers protect data better than social media platforms such as WhatsApp, Meta, and TikTok. Most users view data security as a shared responsibility between themselves and the companies they interact with.

Sustainability is valued, but still not a driver of choice – with little awareness on environmental value of next-gen technologies

While 82% of respondents value sustainability, only 1 in 10 consider it when selecting a provider. However, 45% are willing to accept lower video quality to reduce energy consumption, with younger people showing greater openness to this trade-off. Awareness of the sustainability of new technologies like fibre is relatively low, with only 48% being aware that fibre is more sustainable than traditional phone lines. Therefore, raising awareness about the environmental benefits of these technologies is crucial.

Affordability remains key: Europeans think operators, governments and big tech should be jointly responsible

Reeling from years of high inflation across the consumer basket, Europeans continue considering that affordability is a key matter when it comes to access to connectivity. The survey finds that, while 33% of Europeans feel that telecom prices have remained stable in recent years, 60% perceive that there have been price increases. This should be read in combination with Eurostat figures, showing that communications prices have decreased by -3.3% over the past decade, as opposed to the average consumer index, which increased by +27%.

Notably – when asked who should have the responsibility to keep telecom services affordable – consumers indicate that it should be a shared duty of telecom providers (55%), the government (45%) and technology companies (43%).

Gerd Callewaert, Managing Director Belgium, IPSOS, said: “Our research shows that consumers consider, now more than ever in today’s digital age, connectivity a basic need. It is therefore crucial that telecommunication services remain accessible for all Europeans. Data security is also becoming more important, but here consumers tend to insufficiently adapt their behaviour (eg on password security), despite their concerns”.

Alessandro Gropelli, Director General-Designate of Connect Europe, said: "The fact that Europeans consider networks essential means there is a strong case for an ambitious Digital Networks Act. The status quo is not an option, we must work to bring 5G, fibre and gigabit to all European citizens and businesses".